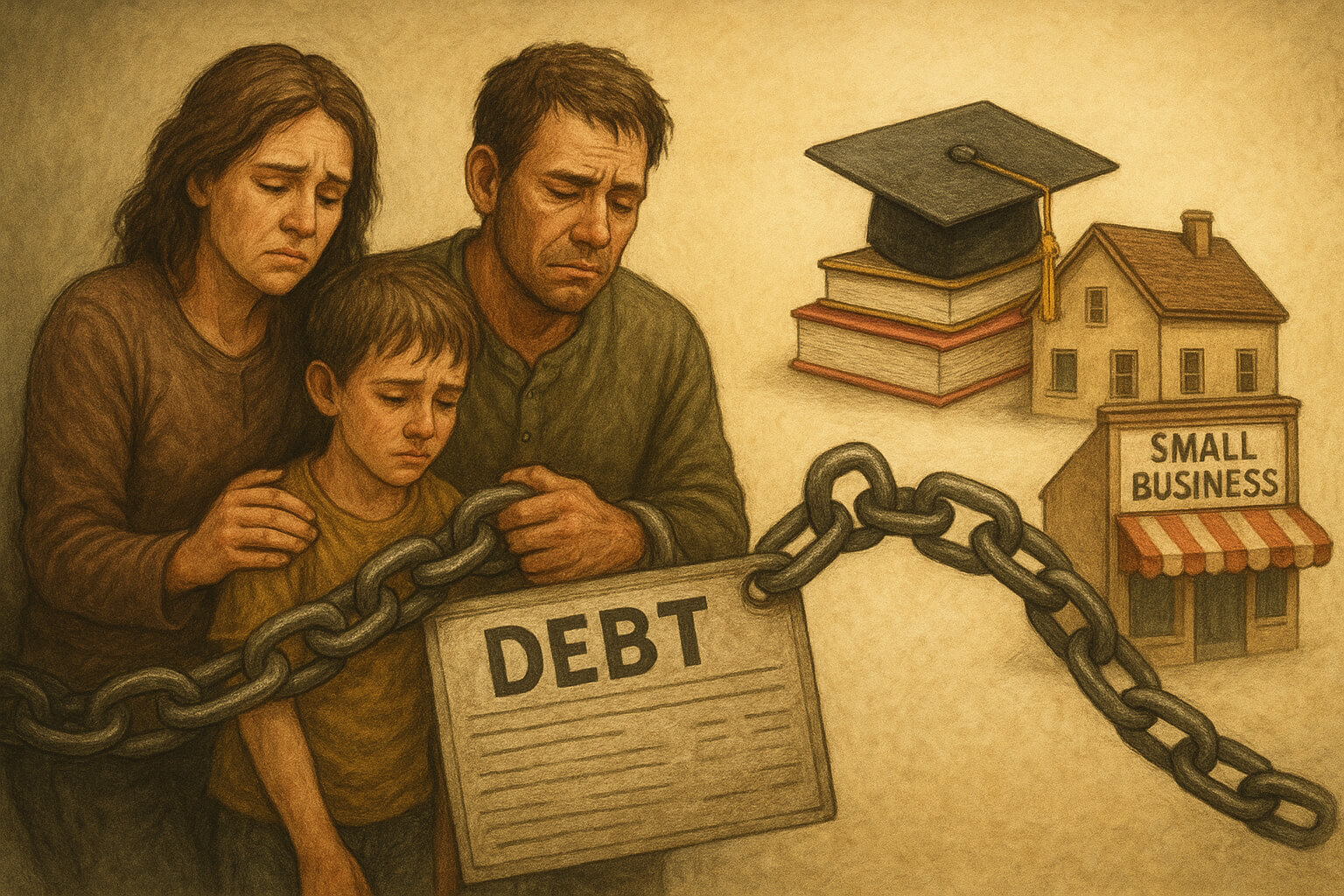

The Impact of Debt on Poverty: Breaking the Cycle

Debt is often viewed as a financial tool that helps families invest in education, housing, or businesses. However, for millions of people worldwide, debt can become a trap that deepens poverty rather than alleviates it. Understanding the relationship between debt and poverty is crucial for breaking the cycle and creating sustainable opportunities for upward mobility.

How Debt Contributes to Poverty

- For low-income families, borrowing often starts as a necessity—whether to cover medical bills, food costs, or housing expenses. Unfortunately, high-interest rates, predatory lending practices, and limited access to fair credit often lead to mounting debt. As the debt grows, the ability to repay it diminishes, and the cycle of poverty becomes more entrenched.

- This cycle is compounded by income inequality and limited safety nets, which exacerbate the financial burden of debt. According to research, when families allocate more of their income to debt repayment than to essentials like education or healthcare, it stunts their ability to break free from poverty and limits future opportunities for growth and stability. (Learn more about income inequality).

Debt, Housing, and Basic Needs

- One of the most pressing effects of debt is housing insecurity. Families burdened by debt often struggle to keep up with rent or mortgage payments, and the priority given to debt repayment can result in the loss of housing. Without stable shelter, other aspects of life—like health, safety, and employment—become compromised. Addressing affordable housing is a key part of breaking the cycle of poverty. (Read more about the importance of housing).

- Food insecurity is another critical issue exacerbated by debt. With limited income available after debt payments, families may find it difficult to afford nutritious meals, leading to poor health outcomes. This, in turn, reduces the ability to work or attend school, perpetuating cycles of poverty and limited opportunity. (Understand food insecurity here).

The Role of Microfinance and Fair Credit

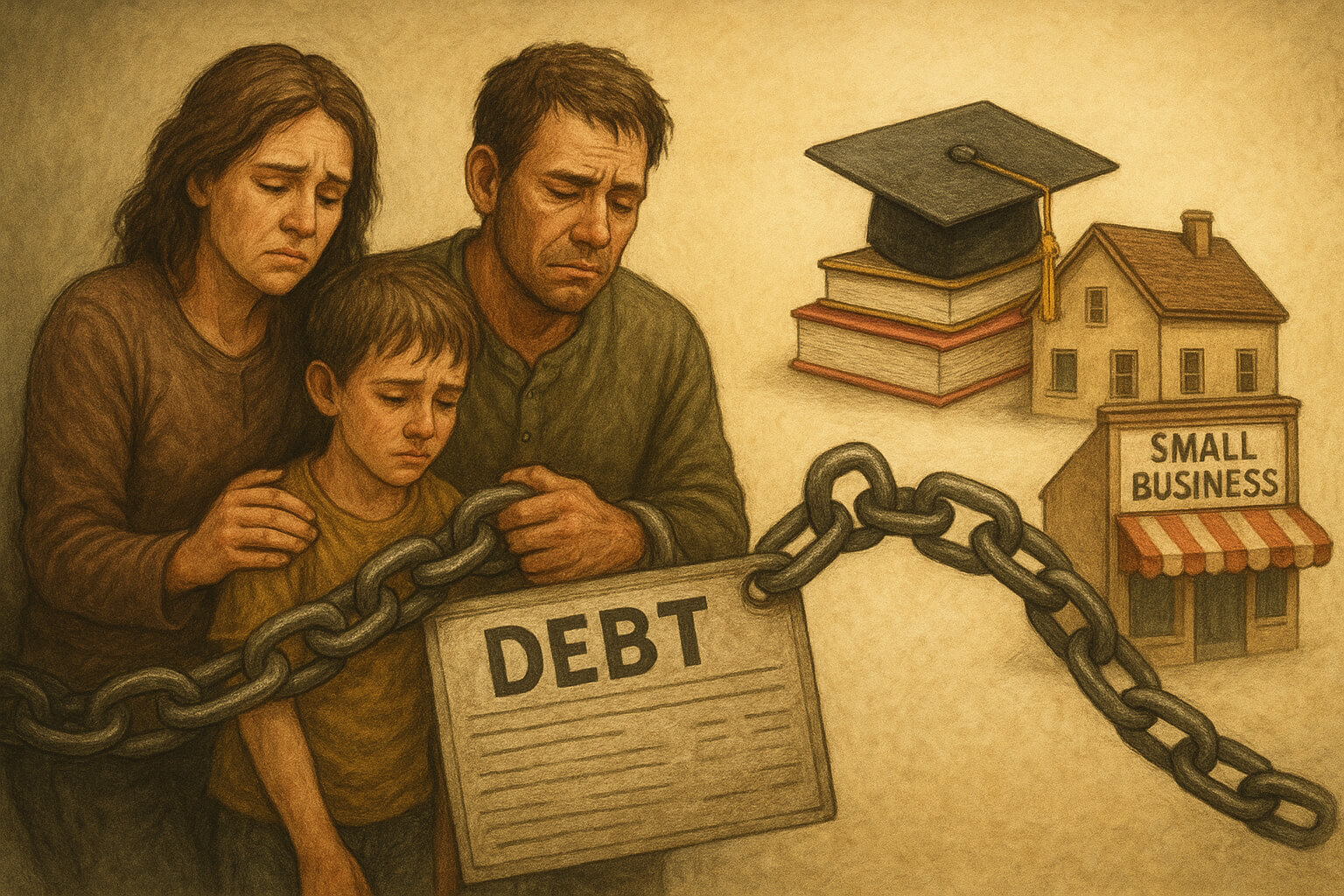

- One effective way to counteract the negative impacts of debt is through microfinance—small loans with low interest rates that enable individuals to start businesses and generate sustainable incomes. Microfinance helps break the dependency on high-interest, exploitative lending and fosters financial independence by empowering people to manage their own businesses and build wealth. (Explore how microfinance empowers communities).

- In addition to microfinance, fair credit practices—such as providing loans at affordable rates—reduce reliance on predatory financial systems. Fair trade practices also help by ensuring that workers and small producers are paid fairly for their goods and services, reducing the need for them to resort to high-interest borrowing in order to meet basic needs. (Learn about fair trade practices).

Breaking the Cycle Through Education and Social Safety Nets

- Education is one of the most powerful tools in combating the debt-poverty cycle. Families with access to quality education are more likely to secure well-paying jobs, thereby improving their ability to pay off debt and avoid future borrowing. Education not only provides individuals with the skills they need to thrive but also empowers future generations to break free from the cycle of poverty. (See the impact of education on poverty reduction).

- Alongside education, social safety nets—such as healthcare, childcare, unemployment support, and subsidized housing—are essential in reducing the likelihood that families will resort to high-interest borrowing during times of crisis. These safety nets offer a critical buffer that helps families weather economic shocks and maintain their stability. (Learn about social safety nets).

- Organizations like the World Bank and OECD offer extensive research on how systemic policy reforms in education, healthcare, and social protection can reduce the burden of debt and poverty worldwide.

Building Pathways to Financial Freedom

- To break the debt-poverty cycle, both individual support and systemic change are necessary. Solutions must focus on expanding access to affordable credit, fostering education and vocational training, and strengthening social safety nets to reduce reliance on debt during times of hardship. Promoting financial literacy is equally important, as it helps individuals make informed decisions about borrowing and saving, ensuring they understand the long-term impact of their financial choices.

- Key steps to breaking the cycle include:

- Expanding access to affordable credit and microfinance options.

- Strengthening education and providing vocational training to enhance earning potential.

- Implementing social safety nets that reduce the need for borrowing in times of crisis.

- Promoting financial literacy to enable individuals to manage their finances effectively and avoid falling into the debt trap.

- When these solutions are combined, they don’t just alleviate the immediate burden of debt—they create long-term opportunities for sustainable prosperity and financial independence.

Final Thoughts

- Debt doesn’t have to be a life sentence. With the right policies, financial education, and access to supportive systems, families can break free from the cycle of debt and build a secure future. By focusing on equity, empowerment, and justice, we can transform debt from a tool of oppression into a pathway to opportunity.

- By addressing the root causes of debt—such as income inequality, inadequate housing, and lack of access to fair credit—we can create lasting change that helps individuals and communities escape the clutches of poverty and build pathways to financial freedom.

- For more insights on the impact of debt and strategies for breaking the cycle, explore these resources:

- Debt should not be a barrier to opportunity. With the right support systems, families can escape its grip and build a future of financial stability and independence. It’s time to break the cycle and create a more just, prosperous world for all.